The reasons behind liking or disliking someone are obviously more emotional than logical. As a study by Frank Bernieri of Oregon State University indicates, we make strong initial judgments of a person from observing just a few seconds, or a “thin slice”, of their behavior.

It is absolutely safe to say that the same applies to how your customers feel about your business. How important is the role of emotions in online shopping? Do shoppers feel like buying from your store, or do they have reasons to ditch you for your competitors? There are plenty theories and studies out there exploring why consumers buy.

Marketers know that an understanding of consumer purchase behavior is crucial and must be based on knowledge of human psychology and the paramount influence that emotions have on decision-making.

Emotions in the Online Buying Process

When your customers shop at your store they will likely try to apply logic to compare product features, prices, reviews to justify a product preference. Neuroscience, however, claims that at the point of choosing a product emotions are more important drivers than logic. If your store and the shopping experience you offer just doesn’t feel right for your customers, their emotions are signaling them from their subconscious mind: “don’t buy here!”

So, while you’re trying to give them logical reasons to purchase your product (e.g. lower price or fast delivery), you must also try to trigger the right emotions in order to seal a sale.

You hear that buzz sentence resonating everywhere: “improve customer’s shopping experience.” But it’s more than a buzz – in today’s competitive retail landscape its the only way how retailers can survive: offering the uniqueness that your competitors lack.

If you’re a retailer, you surely do provide some kind of support services like live chat or phone support – the question is whether you offer it to the right customer in the right stage of their decision-making process.

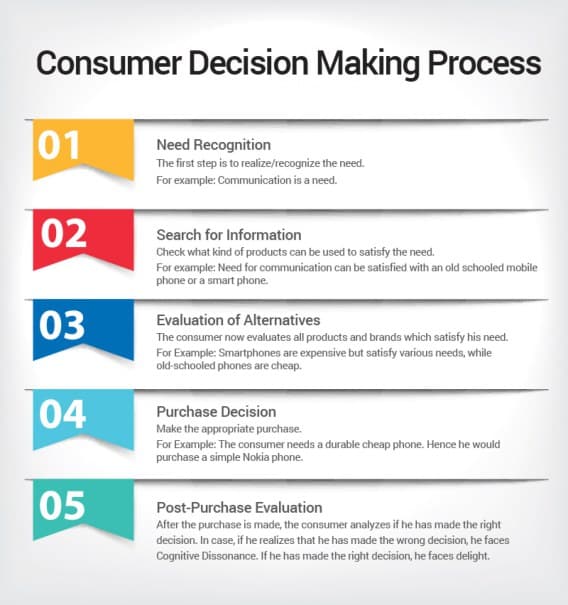

A shopper usually goes through 5 stages in their buying process:

Especially in the stages like Information search and Evaluation of alternatives, most customers do not feel particularly confident, which has the potential to trigger strong emotions like frustration, confusion or annoyance.

Frustrated shoppers who are unable to choose will most likely postpone their purchase, whereas confused shoppers may rush themselves only to get over with it quickly, and choose something they will regret later. Annoyed shoppers on the other hand, are quick to leave your store and head straight to a competitor, swearing to never ever return. The effects of a bad experience.

Smart sellers should focus particularly on these two most critical stages and step up as trustworthy authority that supports overwhelmed customers. It’s best done by giving shoppers the reassurance and confidence they need to follow through with the purchase.

Read more: 4 Elements of a Frictionless Shopping Experience

You have to actively help your shoppers to walk through the decision-process smoothly. The more customer-oriented you design these stages in the purchase process, the more positive emotions will shoppers associate with your store.

A real life example: After receiving a horrible service at my current mobile provider, I decided to switch and tried finding the most suitable plan on competitor websites. Bottom line: Despite the pain connected with it, I’m still with my old provider as its competitors just failed to guide me to a purchase decision and made it too hard for me to choose the right plan in their complicated web of options and packages.

At some point, I wished I was living in Switzerland: Swisscom does it right by offering visitors to their website an easy-to-use guide that helps shoppers navigate and make a purchase decision online.

Subscribe to our FREE newsletter and get new articles straight to your inbox!

Join over 70,000 people who want to stay inspired and help people decide.